Through the roof: Inside London's red-hot real estate market

Pent-up demand, not enough houses for sale and cheap money are driving London-area home prices to record highs. Outsiders flooding in and more investors buying in are also factors.

Article content

Pent-up demand, not enough houses for sale and cheap money are driving London-area home prices to record highs. Outsiders flooding in and more investors buying in are also factors. Jonathan Juha breaks down what’s happening in area real estate and where the market’s headed.

On a quiet residential street in London’s White Oaks neighbourhood stands a house realtors would call a “typical, growing-family-style home.”

It has two floors, three bedrooms, two baths and a single-car garage.

Built in the 1970s as a starter home, it first sold in 1991, amid a brutal economic recession, for $161,000. That was $6,000 below the asking price.

The brick-and-siding house wouldn’t sell again for another 15 years. But when it did, in 2006, it fetched $212,000 — a $51,000 jump in value.

Similar in style to dozens of single-family homes on the same street, the house — whose owners The Free Press was unable to reach — sold again in 2015, this time for $250,000.

It sold once more, last month, for $475,000, $55,000 over the asking price.

While it took the better part of a generation, 24 years, for the property’s price to appreciate by more than half, it nearly doubled during the five years that followed.

That, in a nutshell, is a perfect example of the London area’s unprecedented housing boom, a real estate market whose long-term trend line has shaped up like a hockey stick: mostly flat before 2015, then going nowhere but up.

“Before 2015, we had probably a 30-year span where we saw small price increases and what we would traditionally call a balanced market,” said Blair Campbell, president of the London St. Thomas Association of Realtors (LSTAR), the umbrella group for area real estate agents.

“We went from that to a very strong seller’s market, and it felt like overnight.”

Experts agree 2015 was the start of the bidding wars, homes selling way above listed prices and deteriorating affordability in the London market, which went from the second-most affordable of Canada’s 11 major markets in early 2019 to fifth a year later, the Canadian Real Estate Association (CREA) says.

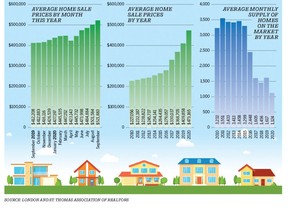

Last month, the average selling price of a London-area home hit a record $520,000, $20,000 more than in August and 28 per cent more than a year ago — a huge jump observers chalk up to pent-up demand after home sales all but ground to a halt during COVID-19’s first wave this spring.

At that price, a family seeking mortgage approval would need to bring in an income of about $105,000. Only 28 per cent of area households make that kind of money, more than $100,000 a year, the latest census in 2016 shows.

If you’re a seller cashing out of your home, and moving into smaller digs, it’s all good.

But in a city facing a housing crisis on many fronts, with hundreds sleeping rough on the street and thousands waiting for social housing, it’s a troubling trend that ripples through the wider market, pricing many would-be, first-time buyers out of homes and leaving little refuge in the rental market, where prices also have soared.

Add to that the economic fallout of COVID-19, in a city battling the pandemic’s second wave while still trying to recover jobs lost during the virus’s first hit, and the surging cost of homes threatens to leave even more behind.

We know where the market is now. But what explains it, and where’s it headed?

HOW DID WE GET HERE?

DEMAND

Getting more than 10 offers on a single property, not uncommon in London now, reflects just one thing: high demand for homes.

And that’s largely due to another kind of growth, in the region’s population.

“Looking at the last three years, London has consistently been one of the fastest-growing Census Metropolitan Areas (CMAs) in Canada,” said Don Kerr, a demographer and professor at Western University’s King’s University College.

The metro London area, which also takes in Strathroy, St. Thomas and parts of Middlesex and Elgin counties, ranked second among Canada’s fastest-growing areas between 2018 and 2019, its population rising by 2.3 per cent, Statistics Canada reports.

That’s roughly three times the region’s growth rate in the 20 years beforehand, said Kerr, noting London has likely gained at least 50,000 people in the last five to six years.

That growth coincided with skyrocketing home prices and the reversal of another trend in 2015, when other Ontarians started moving to London in big numbers.

“For many years since 2008, we had a net loss of people to other parts of the province and other parts of Canada,” Kerr said. “That has not been the case for the last several years, with a substantial turnaround here.”

Immigrants and international students have accounted for many newcomers to London in recent years, but those groups tend to rent for years before buying homes. Another 7,700 people from elsewhere in Ontario, more likely to go into the home market, also flooded into London between 2017 and 2019 alone.

Among those arrivals were many families pushed out of the white-hot Greater Toronto Area market and other nearby cities, by the rising cost of housing. It’s a trend known as “drive until you qualify,” meaning the farther you get from the Toronto area, the more likely you’ll be able to find something you can afford.

“The influx of out-of-town buyers was the telltale sign,” LSTAR’s Campbell said.

“That level of competition was really unprecedented in the London market . . . and what you saw was that wave effect, because values were going up at a much faster rate in areas like Kitchener and Hamilton, prior to London.”

COST OF BORROWING

Out-of-town buyers aren’t the only force greasing London’s market. There’s plenty of homegrown demand, too, observers say, And, with the current rock-bottom cost of borrowing expected to remain near record lows, money talks.

“It’s absolutely a driving factor,” said Dani Hanna, a mortgage broker with Real Mortgage Associates in London.

In March, in the third of three reductions, the Bank of Canada cut its key interest rate target — which influences borrowing rates for consumers — to a historic low of 0.25 per cent in response to the pandemic. The rate had been 1.75 per cent.

That’s seen people approved for fixed, five-year mortgages at rates as low as 1.6 per cent, almost half of what they were only a couple of years ago.

That means the monthly mortgage payment for a home sold at $520,000, the London-area average, with a five per cent down payment of $26,000, is about $2,080.

The lower rates have driven up prices in two ways.

More buyers are going for bigger, more expensive homes, putting upward pressure on average prices, said Andrew Scott, a senior analyst at Canada Mortgage and Housing Corp. (CMHC).

“And that is leading to this change in the composition of the average home that’s being sold,” he said. “You’re seeing larger, more expensive homes selling at the moment, so it’s sort of increased the average price.”

The lower cost of borrowing also has brought in another buyer — the investor — in larger numbers, observers say.

“People are investing more in real estate than they ever have,” Hanna said. “But it’s no longer (just) savvy investors that are investing in real estate; it’s everyday people.

“Teachers, janitors or factory workers — they’re the ones that now are buying real estate as an investment for the future. They’re the ones that are also purchasing now and . . . driving up the prices.”

SUPPLY

With the sharp increase in demand in London, the supply of houses for sale has nosedived, adding more pressure to prices.

“We certainly saw a big spike in demand and that was fairly tough for the supply side to keep pace with,” said CMHC’s Scott. “If you go back five years, population projections at the time weren’t forecasting as much growth as we ended up seeing.”

Between 2010 and 2015, the average number of homes listed for sale in the area market hovered near 3,400 a month, LSTAR figures show.

That number dipped below 3,000 in 2016 and has dropped every year since, hitting a 10-year low of 1,124 this year. And the trend shows no sign of reversing.

“Demand is quite strong compared to the supply,” said Robin Wiebe, a senior economist with the Conference Board of Canada.

The supply of houses in the London-area market is so tight, all of them would be sold in a month and a half if no new ones came on stream. In London alone, the median number of days it takes for a property to sell is eight, down from 28 five years ago, LSTAR figures show.

Not even a strong new home market, averaging more than 3,000 home starts in the last five years, has been enough to keep prices level and absorb all the demand, Scott noted.

WHERE IS THE MARKET GOING?

Market watchers agree on one thing: the London real estate market’s surging prices are highly unusual. But don’t expect the dramatic run-up in prices to last.

“If we were talking about an ideal situation, you would see home prices growing in line with traditional fundamentals like income, employment, GDP (gross domestic product),” said Scott, adding it’s “not very common” for prices to double in only four or five years, as they have in London.

That’s not to say anyone expects prices to fall; only, that they’ll rise less quickly. Abd when that cool-down will begin is anyone’s guess.

“We’ve got low interest rates, recovering employment, strong population growth and the desire of people to move from high-priced markets to maybe a more affordable area,” Wiebe said.

“And as long as those trends continue, then London, and towns like London, they are going to have strong resale markets.”

Though the COVID-19 pandemic remains a wild card, home prices already are worsening London’s affordability issues. More and more first-time buyers, for example, are turning to their parents to co-sign on mortgages.

Renters, too, are feeling the squeeze of high home prices, Kerr said.

“While those owning property are logically pleased, those that have yet to enter the housing market are going to be put in a bind,” he said. “This is particularly true as the rental vacancy rate has also fallen in our cities, and as a result, the cost of renting continues to climb.”

That underlines the need for more affordable housing, not only in London, but across Ontario, Campbell said.

“Supply is our biggest issue,” he said.

“And with a lot of interconnected parts, we have an opportunity now to explore how could we better look at housing supply and make it efficient and safe for people.”